AS ONE MACROECONOMIC

FIRE ABATES,

OTHERS RAGE.

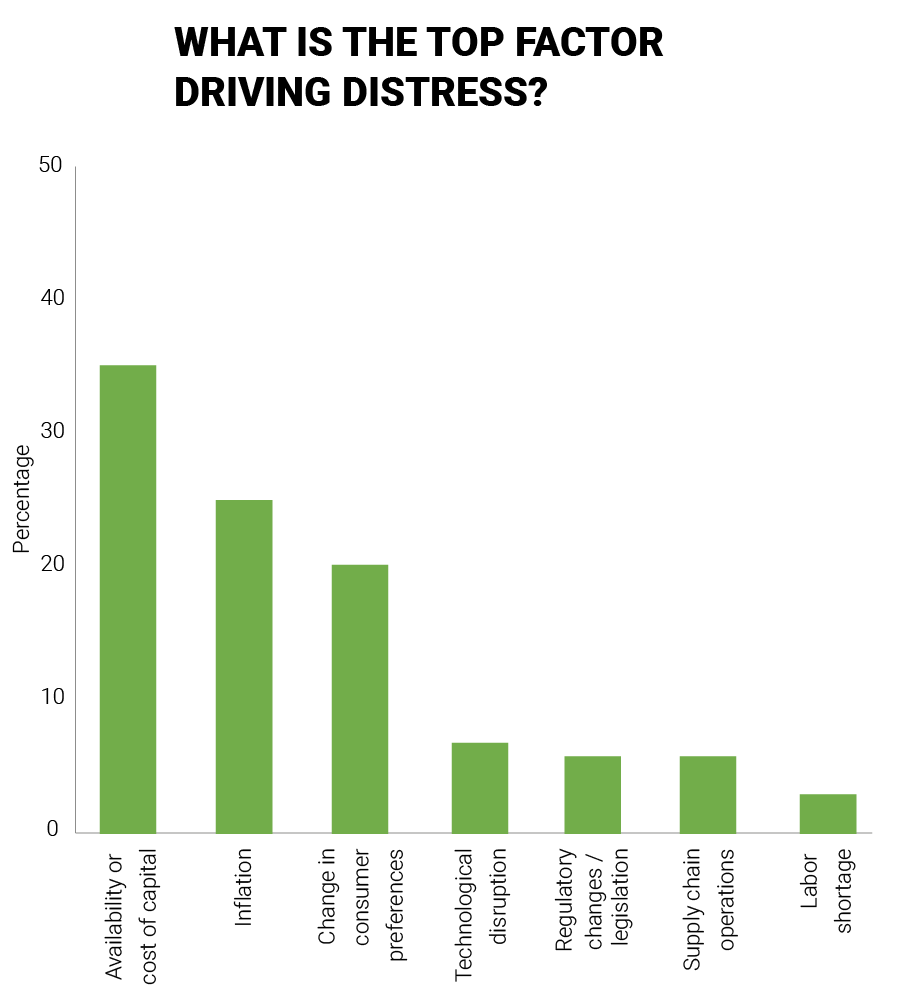

In particular, the rising cost and reduced availability of capital are sounding alarms across the world. These will be the biggest drivers of corporate distress in 2023, according to this year’s Turnaround and Transformation Survey. More than one third (36%) of respondents worldwide cited capital as the main challenge, ahead of inflation at 25%. Capital isn’t just scarce, but harder to secure: almost all (85%) reported a tightening in credit terms, up from 52% in 2022.

The headline findings mask a regional divergence. While capital constraints are seen as the largest single cause of distress in the Americas, respondents in the U.K. cited inflation as the number one issue. This may simply reflect the fact that U.S. inflation has cooled more quickly, with consumer prices increasing at around half the rate compared to the U.K. at the time of our survey. It would not be a surprise to see financing concerns rise further up the agenda in EMEA markets as the year progresses, in line with trends elsewhere.

AS ONE MACROECONOMIC

FIRE ABATES,

OTHERS RAGE.

In particular, the rising cost and reduced availability of capital are sounding alarms across the world. These will be the biggest drivers of corporate distress in 2023, according to this year’s Turnaround and Transformation Survey. More than one third (36%) of respondents worldwide cited capital as the main challenge, ahead of inflation at 25%. Capital isn’t just scarce, but harder to secure: almost all (85%) reported a tightening in credit terms, up from 52% in 2022.

The headline findings mask a regional divergence. While capital constraints are seen as the largest single cause of distress in the Americas, respondents in the U.K. cited inflation as the number one issue. This may simply reflect the fact that U.S. inflation has cooled more quickly, with consumer prices increasing at around half the rate compared to the U.K. at the time of our survey. It would not be a surprise to see financing concerns rise further up the agenda in EMEA markets as the year progresses, in line with trends elsewhere.

MIDDLE-MARKET HEADWINDS

The capital crunch is the latest challenge for executives laboring under the relentless pressure of recent events, from COVID-19 to inflation by way of supply chains. Such a varied series of challenges would test the resilience of any business; leadership teams tell us the accumulated impacts are taking their toll.

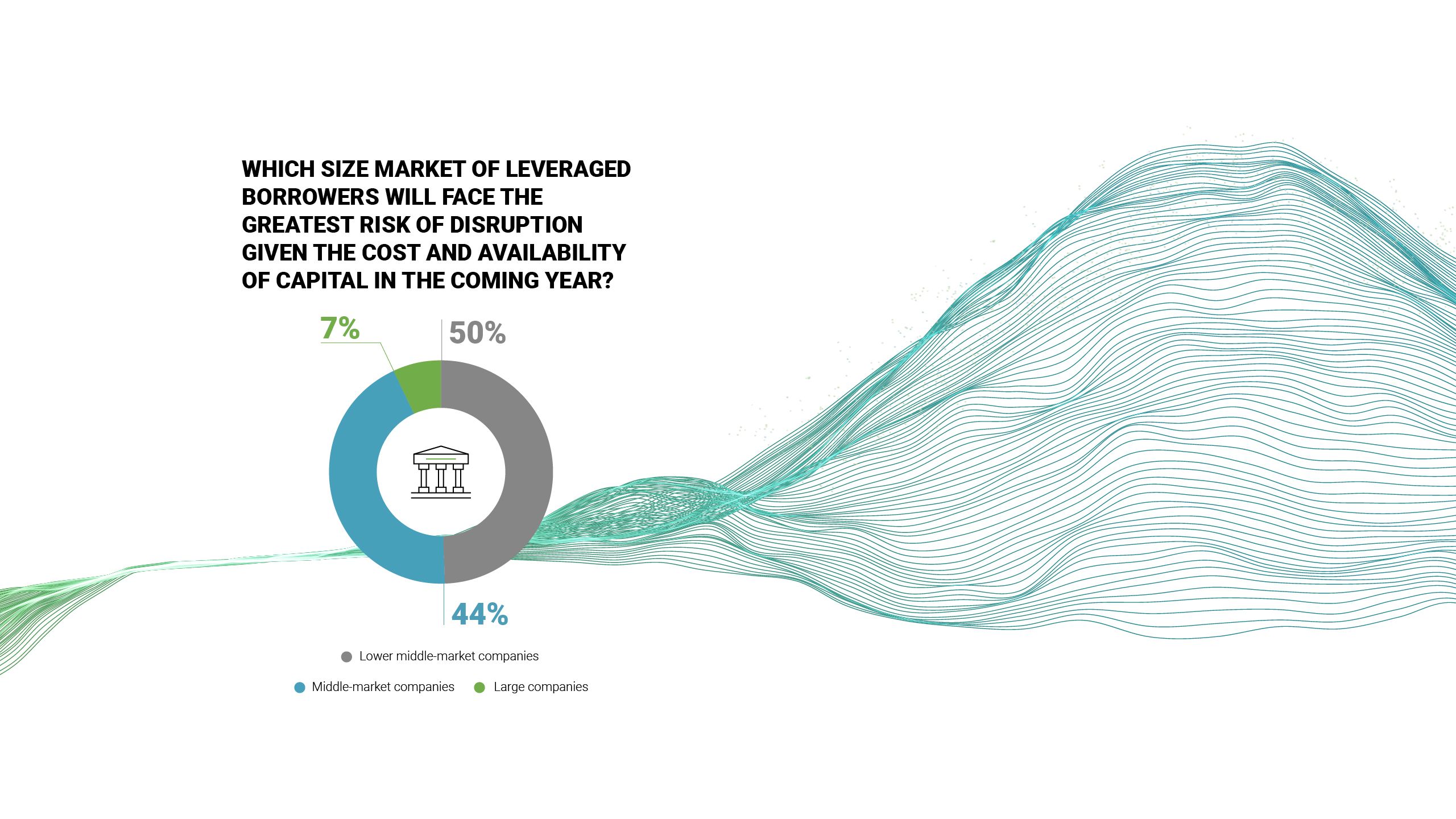

We suspect middle-market companies face particularly intense headwinds. Their relative inability to dictate price – both with consumers and suppliers – is a major disadvantage in an inflationary environment. Middle-market management teams also tend to have fewer levers to pull within the business than large, diversified entities. And smaller corporates drew heavily on government support during the pandemic, which extended well into 2022 in markets such as Germany. The full impact of its withdrawal may not have played out entirely.

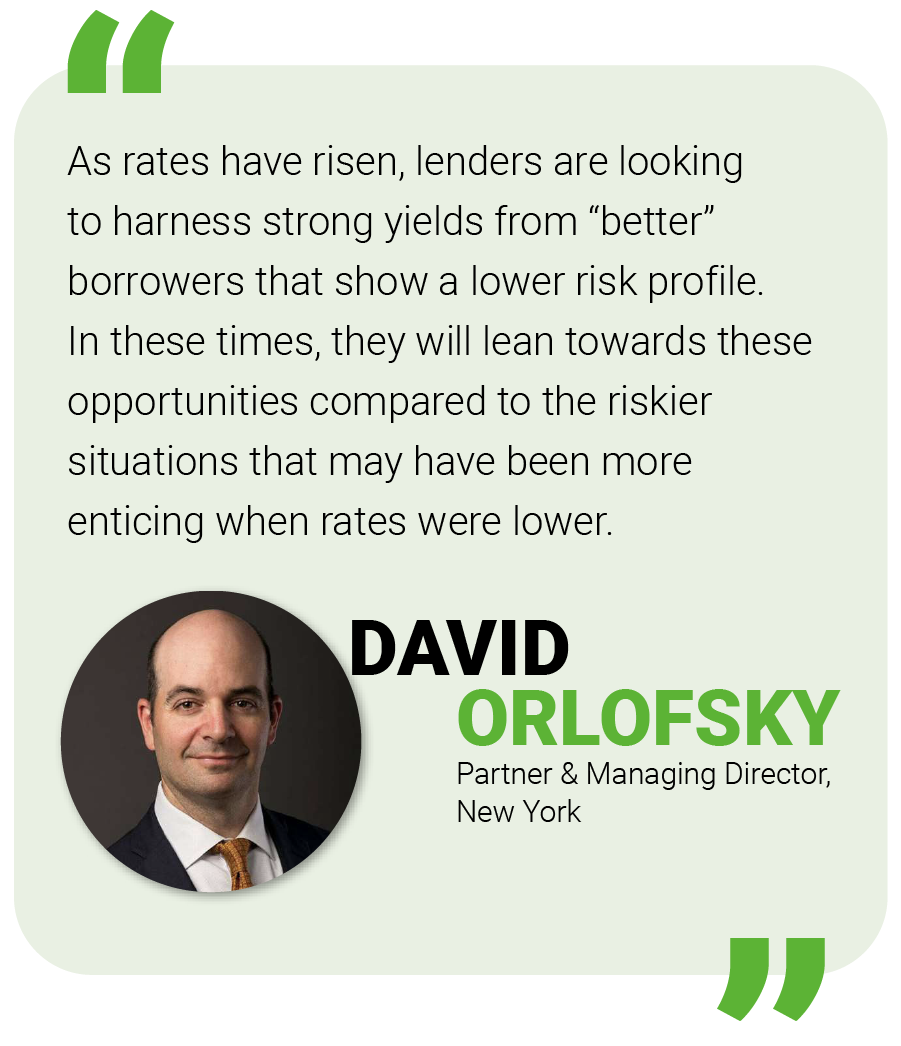

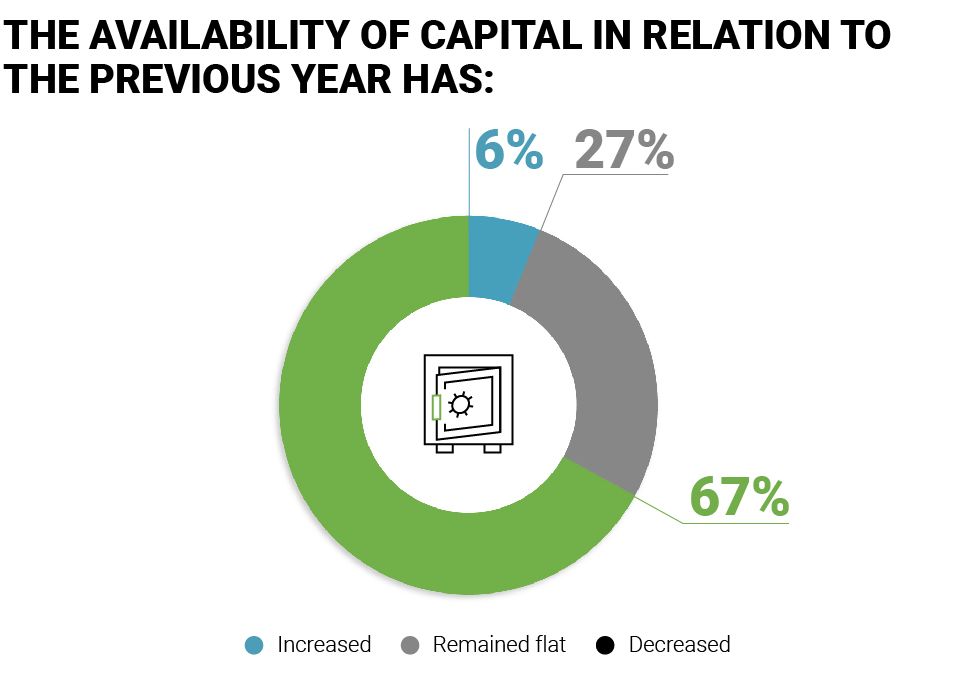

As lenders weigh such considerations, middle- and lower middle-market companies may find themselves with reduced access to the capital that remains in the market, with priority going to those perceived as safer bets. Two-thirds of the experts we surveyed said that capital availability has already decreased in 2023, with just 6% reporting an increase.

MIDDLE-MARKET HEADWINDS

The capital crunch is the latest challenge for executives laboring under the relentless pressure of recent events, from COVID-19 to inflation by way of supply chains. Such a varied series of challenges would test the resilience of any business; leadership teams tell us the accumulated impacts are taking their toll.

We suspect middle-market companies face particularly intense headwinds. Their relative inability to dictate price – both with consumers and suppliers – is a major disadvantage in an inflationary environment. Middle-market management teams also tend to have fewer levers to pull within the business than large, diversified entities. And smaller corporates drew heavily on government support during the pandemic, which extended well into 2022 in markets such as Germany. The full impact of its withdrawal may not have played out entirely.

As lenders weigh such considerations, middle- and lower middle-market companies may find themselves with reduced access to the capital that remains in the market, with priority going to those perceived as safer bets. Two-thirds of the experts we surveyed said that capital availability has already decreased in 2023, with just 6% reporting an increase.

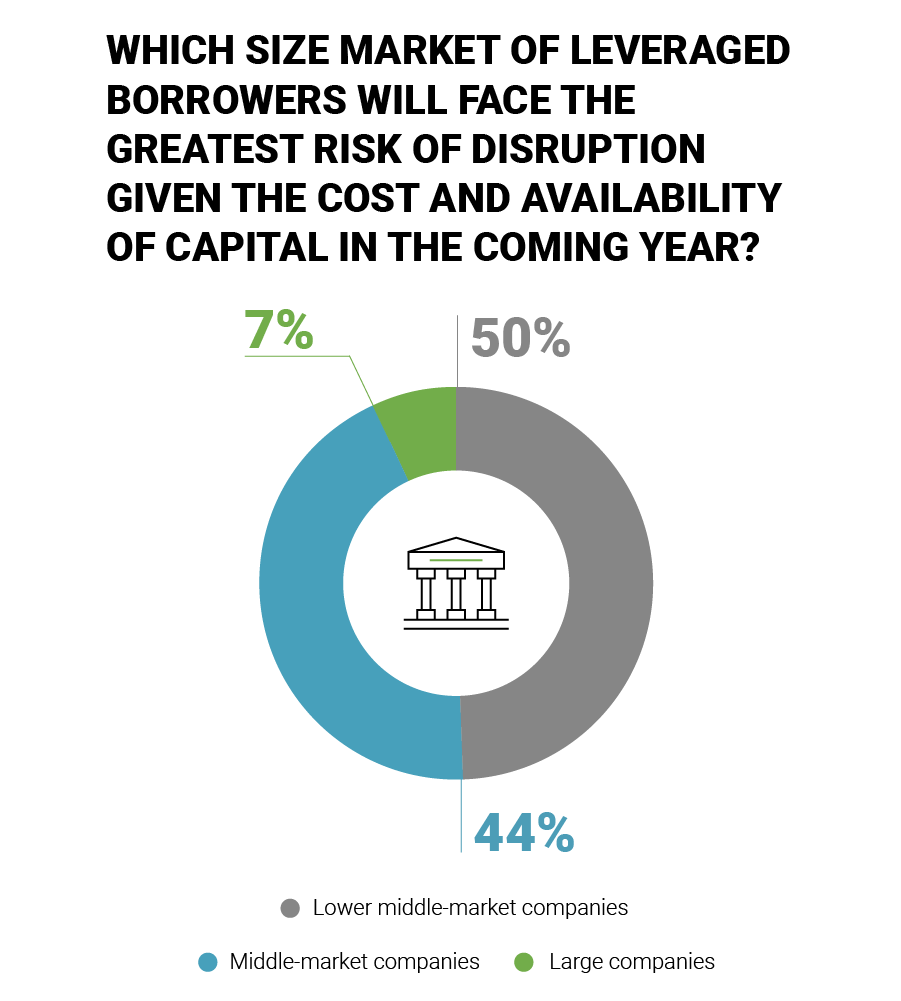

As rates have risen, lenders are looking to harness strong yields from “better” borrowers that show a lower risk profile. In these times, they will lean towards these opportunities compared to the riskier situations that may have been more enticing when rates were lower.

The lingering effect of turmoil in financial services could also be an exacerbating factor. More than three-quarters (78%) of respondents thought that the uncertainties introduced by recent banking failures will worsen capital market conditions.

To respond effectively, businesses need to accept the things they cannot change and display the courage to change what they can. Approaching cost base with a “no-stone-unturned” mindset is a useful defensive move in difficult times. This includes talking to suppliers to ensure cost reductions are being passed on in markets where the price of energy is edging down from recent peaks. Similarly, rigorous cash focus (such as inventory reduction) is within the power of executives to deliver, irrespective of external factors.

As rates have risen, lenders are looking to harness strong yields from “better” borrowers that show a lower risk profile. In these times, they will lean towards these opportunities compared to the riskier situations that may have been more enticing when rates were lower.

The lingering effect of turmoil in financial services could also be an exacerbating factor. More than three-quarters (78%) of respondents thought that the uncertainties introduced by recent banking failures will worsen capital market conditions.

To respond effectively, businesses need to accept the things they cannot change and display the courage to change what they can. Approaching cost base with a “no-stone-unturned” mindset is a useful defensive move in difficult times. This includes talking to suppliers to ensure cost reductions are being passed on in markets where the price of energy is edging down from recent peaks. Similarly, rigorous cash focus (such as inventory reduction) is within the power of executives to deliver, irrespective of external factors.

DOUBLE DOWN ON CRITICAL

BUT COMPLEX REFINANCING

AND OPERATIONAL PLANS

For distressed middle-market companies seeking to refinance in a capital crunch, critical foundation disciplines assume renewed importance. The best way to address the growing uncertainty and never-ending disruption is a return to “no regret” moves that propel the business forward. Open dialogue and well-reasoned requests to lenders help demonstrate the soundness of a business and its management; too many boardrooms assume that what is obvious to them will be obvious to others. And, as ever, it pays to get ahead of potential problems and be open minded; in the current environment, capital solutions are more complicated and will likely take more time to implement compared to when interest rates were lower.

Above all, those hoping to buy time through an amend and extend exercise need a clear idea of what they are buying time for. Pushing out debt maturity may be appropriate to take a company to a major corporate event (such as a sale or equity injection) or alongside an operational transformation to address underlying structural problems, which is easier said than done. At a time when clarity and certainty are at a premium for business leaders, success in this respect involves building a bridge, not a pier.

DOUBLE DOWN ON CRITICAL

BUT COMPLEX REFINANCING

AND OPERATIONAL PLANS

For distressed middle-market companies seeking to refinance in a capital crunch, critical foundation disciplines assume renewed importance. The best way to address the growing uncertainty and never-ending disruption is a return to “no regret” moves that propel the business forward. Open dialogue and well-reasoned requests to lenders help demonstrate the soundness of a business and its management; too many boardrooms assume that what is obvious to them will be obvious to others. And, as ever, it pays to get ahead of potential problems and be open minded; in the current environment, capital solutions are more complicated and will likely take more time to implement compared to when interest rates were lower.

Above all, those hoping to buy time through an amend and extend exercise need a clear idea of what they are buying time for. Pushing out debt maturity may be appropriate to take a company to a major corporate event (such as a sale or equity injection) or alongside an operational transformation to address underlying structural problems, which is easier said than done. At a time when clarity and certainty are at a premium for business leaders, success in this respect involves building a bridge, not a pier.

DISCOVER MORE: CERTAIN MOVES IN AN UNCERTAIN WORLD

Insights from the AlixPartners

18th Annual Turnaround and Transformation Survey.

METHODOLOGY

Research for the 18th Annual Turnaround and Transformation survey was conducted between May 2 and 25, 2023. Respondents comprised 700 lawyers, investment bankers, lenders, financial advisors, and other industry executives involved in corporate workouts representing more than 20 major industries across the Americas, Europe, the Middle East and Africa, and Asia.